Stamp duty is a state-imposed tax that pays for the transfer of property from one owner to another. This is a compulsory tax that is levied on a number of purchases like cars and businesses, but it’s most commonly known as the tax you pay when you buy a house or land. The government provides stamp duty relief for eligible pensioners. In some circumstances, you may be eligible for a concessional rate of stamp duty, but this will depend on a range of factors. For example, most states and territories have some type of concession for first home buyers, the amount of which depends on the value of the property and whether you’re buying a vacant block of land or a new house.

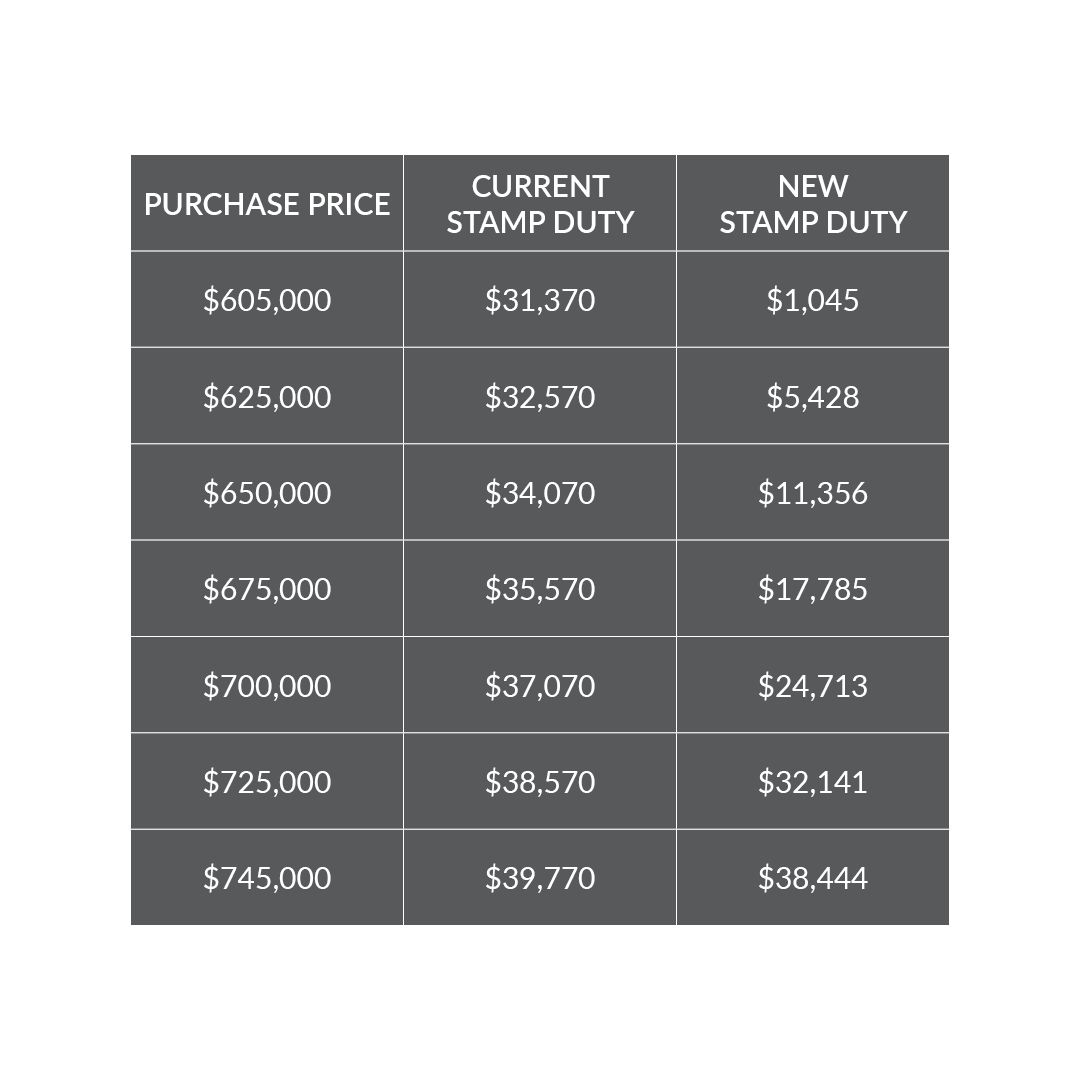

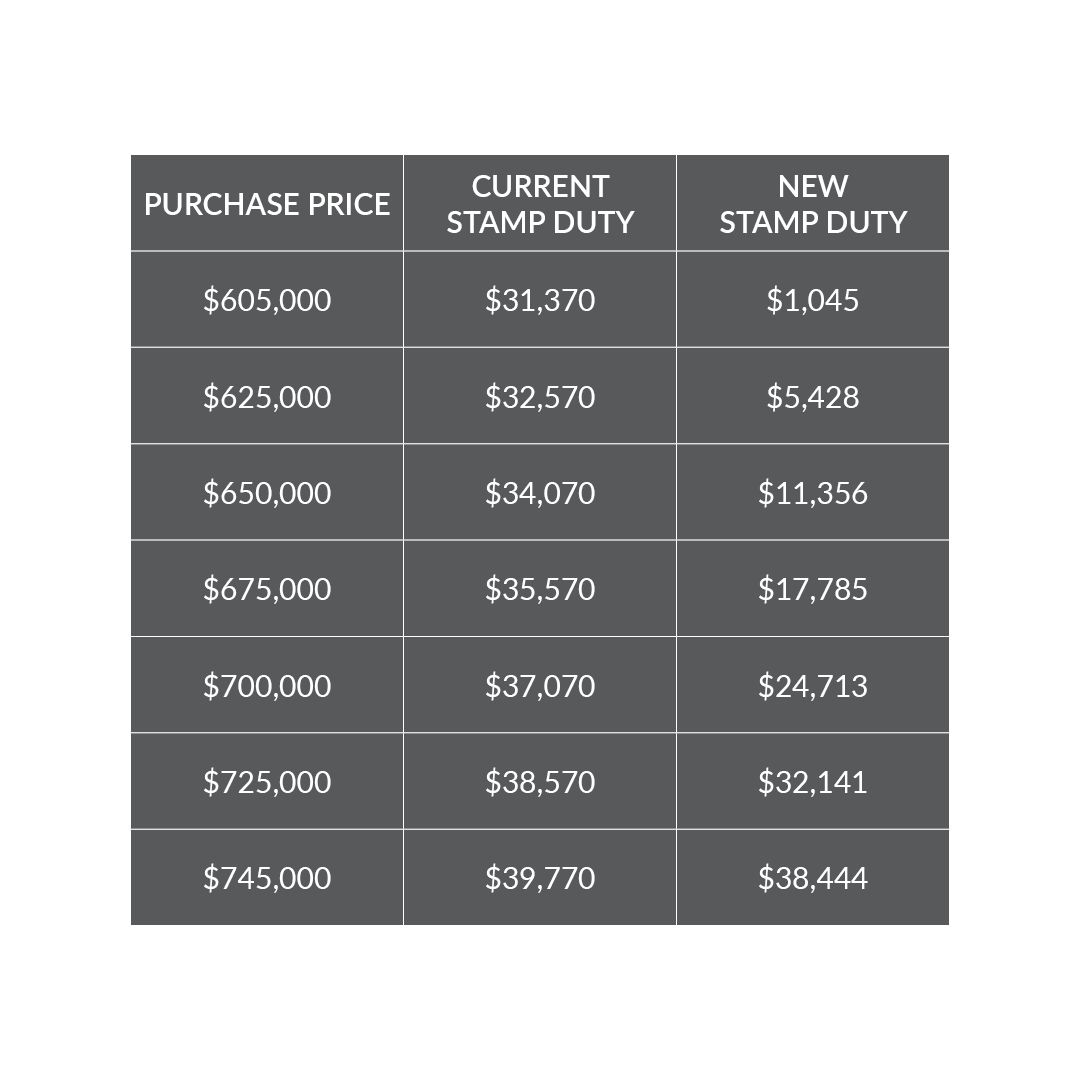

How does the concessional rate of duty work? The concession applies on a sliding scale. The closer the dutiable value is to $600,001, the greater the concession. However, if the purchase price is lower than $600,000 first-home buyers will be exempt from the stamp duty. See the table below for further info.

If you would like help and advice regarding a purchase, speak to one of our friendly agents today, 9781 2111