Melbourne and Darwin’s housing markets are finally heating up after sitting out the boom, with Darwin prices jumping 11 per cent and Melbourne hitting a new all-time high.

Two of Australia’s quieter housing markets are now showing clear signs of recovery. Melbourne and Darwin, both late to join the upswing, are beginning to move back into growth territory. Sellers are taking advantage of market conditions with both cities seeing a boost in properties for sale over the past month.

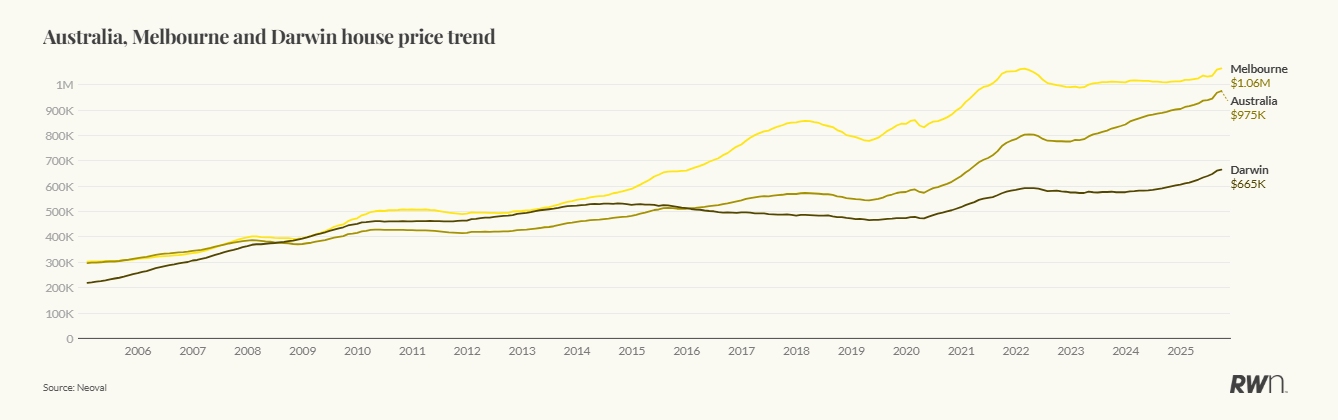

House prices in Melbourne increased 3.1 per cent over the past three months and 5.3 per cent over the year, their strongest pace in more than two years. While still below the national average growth, it marks a clear turnaround from the flat conditions that characterised 2023 and early 2024. Melbourne has now edged just above its previous peak, with prices sitting slightly higher than the highs reached during the 2021–22 upswing, a symbolic milestone that confirms the city’s return to growth.

Darwin’s rebound has been even more pronounced. Prices there have risen 3.9 per cent over the quarter and 11.1 per cent over the year, placing it alongside Perth, Adelaide and Brisbane as one of the strongest performers nationally.

While the early part of this cycle was dominated by the smaller capitals – particularly Perth and Adelaide – the latest data suggest a broadening in momentum. Buyers are returning to Melbourne as relative affordability improves and population inflows rebuild following several years of subdued migration. The market is still operating below its long-term potential, but the direction of movement is clearly upward.

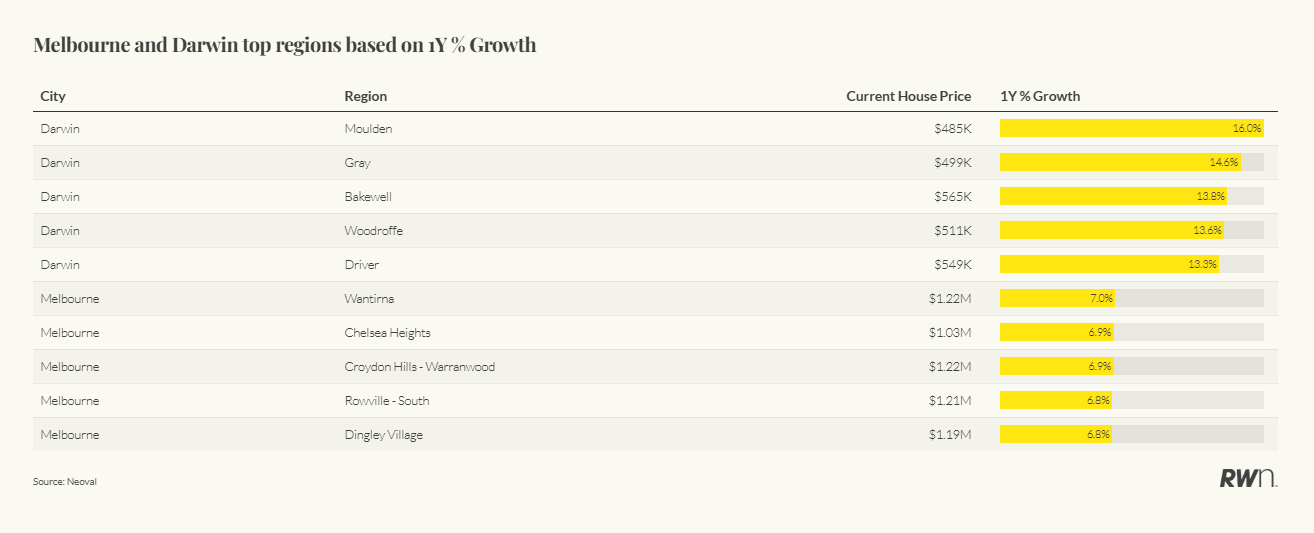

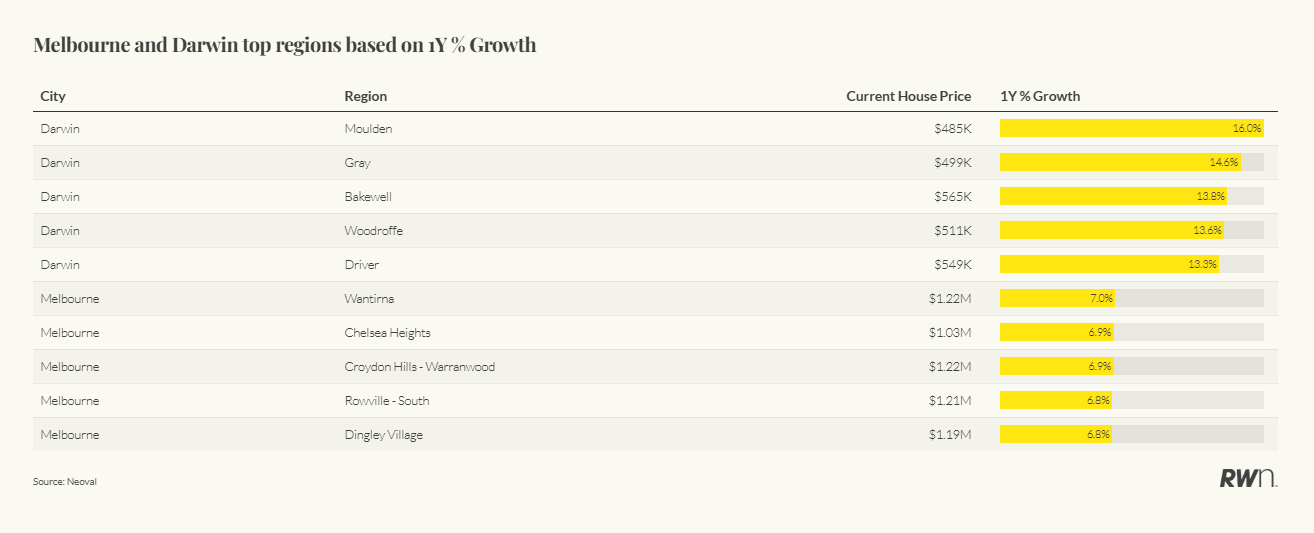

Darwin’s recovery is being driven by extreme supply shortages and strong investor demand. Rental yields remain among the highest in the country, while new construction is limited. With fewer than 200 new listings recorded in September and sales volumes lifting sharply, prices have been quick to respond. Suburbs such as Moulden, Gray, Bakewell and Woodroffe have led the way, recording annual growth between 13 and 16 per cent. These areas are typically middle-ring family suburbs within 20 kilometres of the Darwin CBD, offering affordable freestanding homes and appealing rental returns, the type of stock now most in demand from both investors and first-home buyers.

In Melbourne, the strongest growth has been recorded in established middle-suburban areas including Wantirna, Chelsea Heights, Croydon Hills–Warranwood, Rowville and Dingley Village, where annual price gains range between 6.8 and 7.0 per cent. These are not the city’s most expensive postcodes, but they sit in well-connected, family-oriented corridors that have benefitted from improving affordability and renewed buyer confidence as borrowing conditions ease.

The broader trend data also reinforce how the two markets have diverged and converged over time. Melbourne remains well above its long-term trajectory, with a current median house price of around $1.06 million, while Darwin, at $665,000, is still below its 2014 peak but clearly regaining lost ground. The narrowing gap visible in long-run price trends shows how the national recovery is now spreading to the markets that were slowest to move.

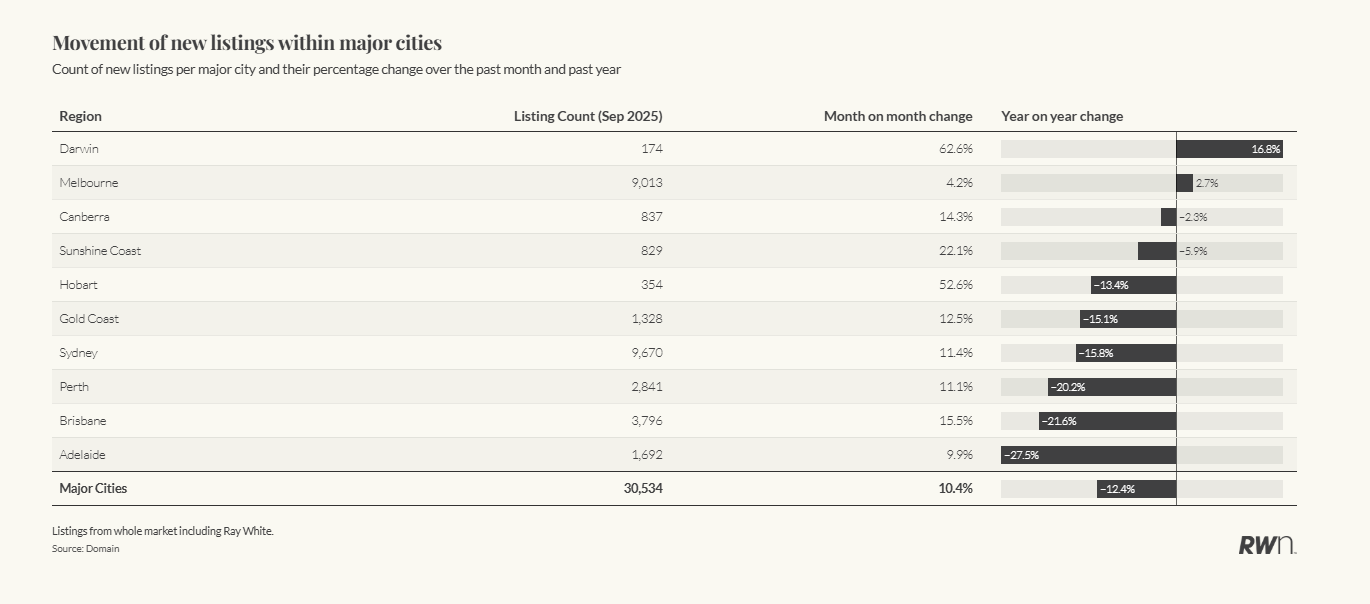

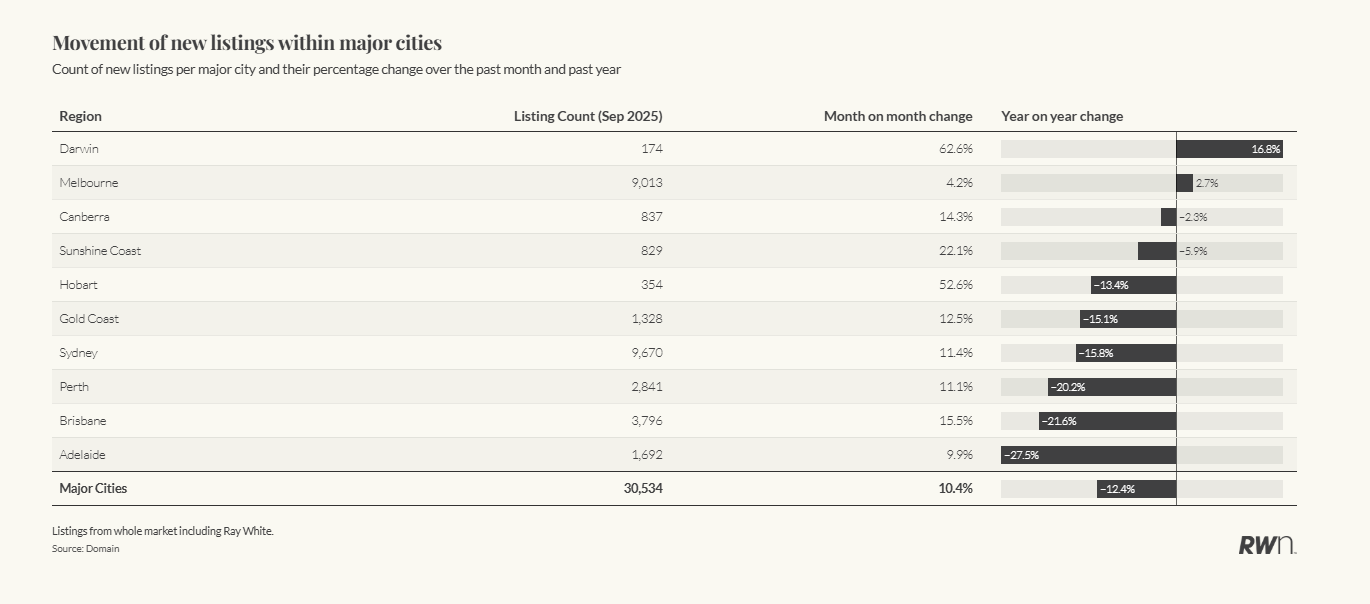

The lift in new listings confirms that sentiment is improving. Listings data across all agencies show Darwin listings up 62.6 per cent month-on-month and 16.8 per cent year-on-year, while Melbourne listings rose 4.2 per cent over the month. Rising supply in strengthening markets typically signals confidence rather than weakness, as vendors take advantage of firmer prices and faster sales.

Looking ahead, conditions are likely to remain supportive through the final quarter of the year. The possibility of a November rate cut would provide an additional boost to sentiment and borrowing capacity heading into summer. Combined with continued population growth and tight construction pipelines, this would further underpin price momentum.