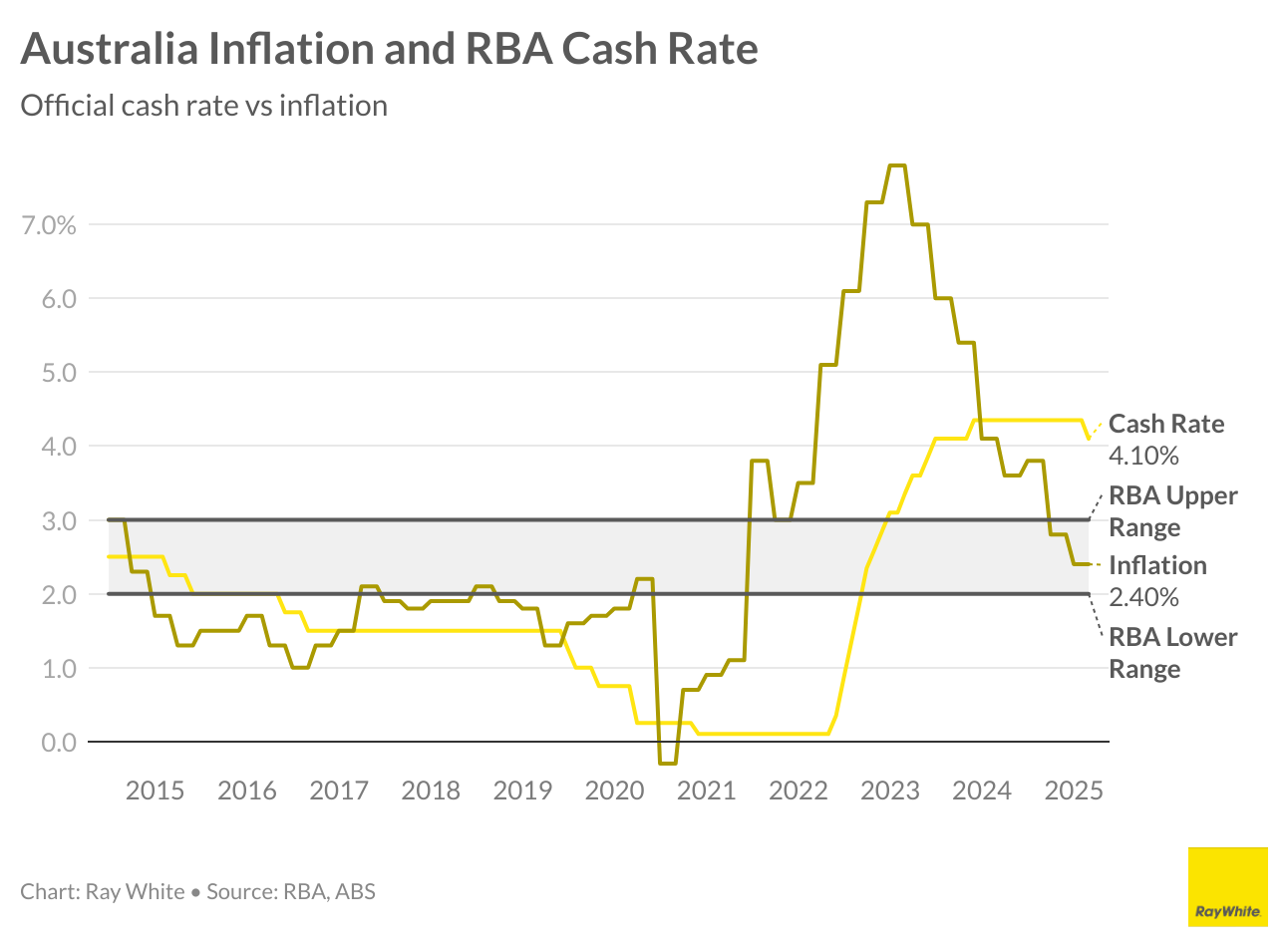

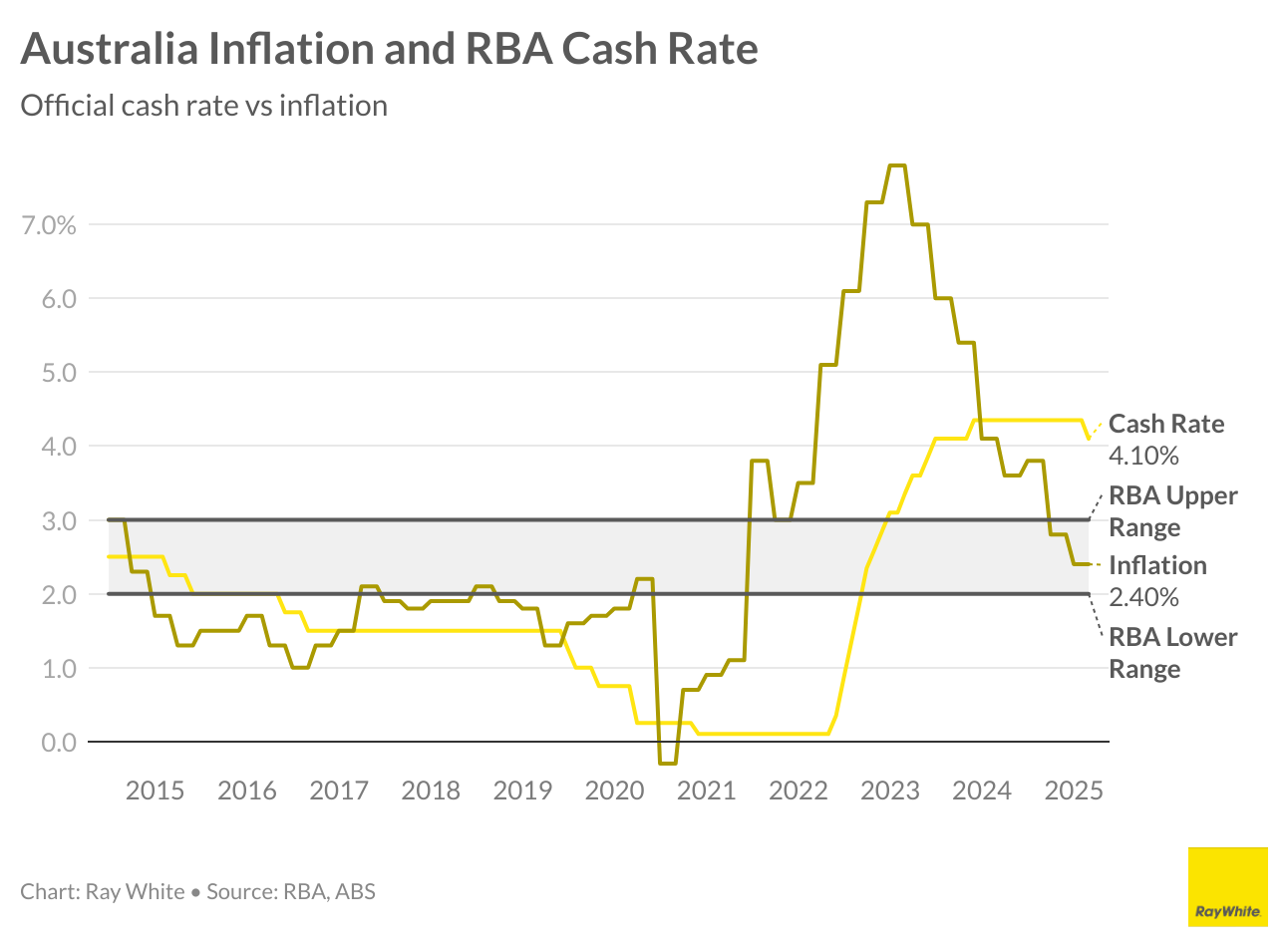

Inflation has now been within the Reserve Bank of Australia’s (RBA) target for two quarters and finally they have decided to cut.

Why the hesitation? The main issue was that the economy remained relatively stable. In particular unemployment remained low and as yet, there are no immediate signs of recession. In addition, headline inflation was seen to be artificially low, driven in part by the Federal Government’s $300 rebate on household electricity costs. Therefore, the RBA instead focused on the trim mean inflation which excluded this, as well as a number of other items. Trimmed mean inflation is still slightly above the 2-3 per cent target.

So why the cut now? Unemployment in December rose more quickly than expected and it now appears that not only are households feeling the pinch, but so too are businesses, impacting their hiring decisions. This cut is aimed at reducing borrowing costs and providing more momentum into the economy.

So why the cut now? Unemployment in December rose more quickly than expected and it now appears that not only are households feeling the pinch, but so too are businesses, impacting their hiring decisions. This cut is aimed at reducing borrowing costs and providing more momentum into the economy.

It’s expected that this will be the first cut of many. At this point, it is likely we will see three more cuts this year, however there continues to be rising uncertainty. Trade disruptions are expected throughout the year as a result of US tariffs, and Middle East conflict may bring an end to the lower fuel prices we have seen in recent months. Both of these have the potential to re-ignite inflation and could bring an abrupt end to interest rate cuts.

For housing, it’s likely to lead to strong pricing conditions. Although the market slowed at the end of last year as a result of more homes coming up for sale, we had already seen signs of recovery in January. The downturn appears to have already been reversed and this will provide more momentum into the market.

So why the cut now? Unemployment in December rose more quickly than expected and it now appears that not only are households feeling the pinch, but so too are businesses, impacting their hiring decisions. This cut is aimed at reducing borrowing costs and providing more momentum into the economy.

So why the cut now? Unemployment in December rose more quickly than expected and it now appears that not only are households feeling the pinch, but so too are businesses, impacting their hiring decisions. This cut is aimed at reducing borrowing costs and providing more momentum into the economy.